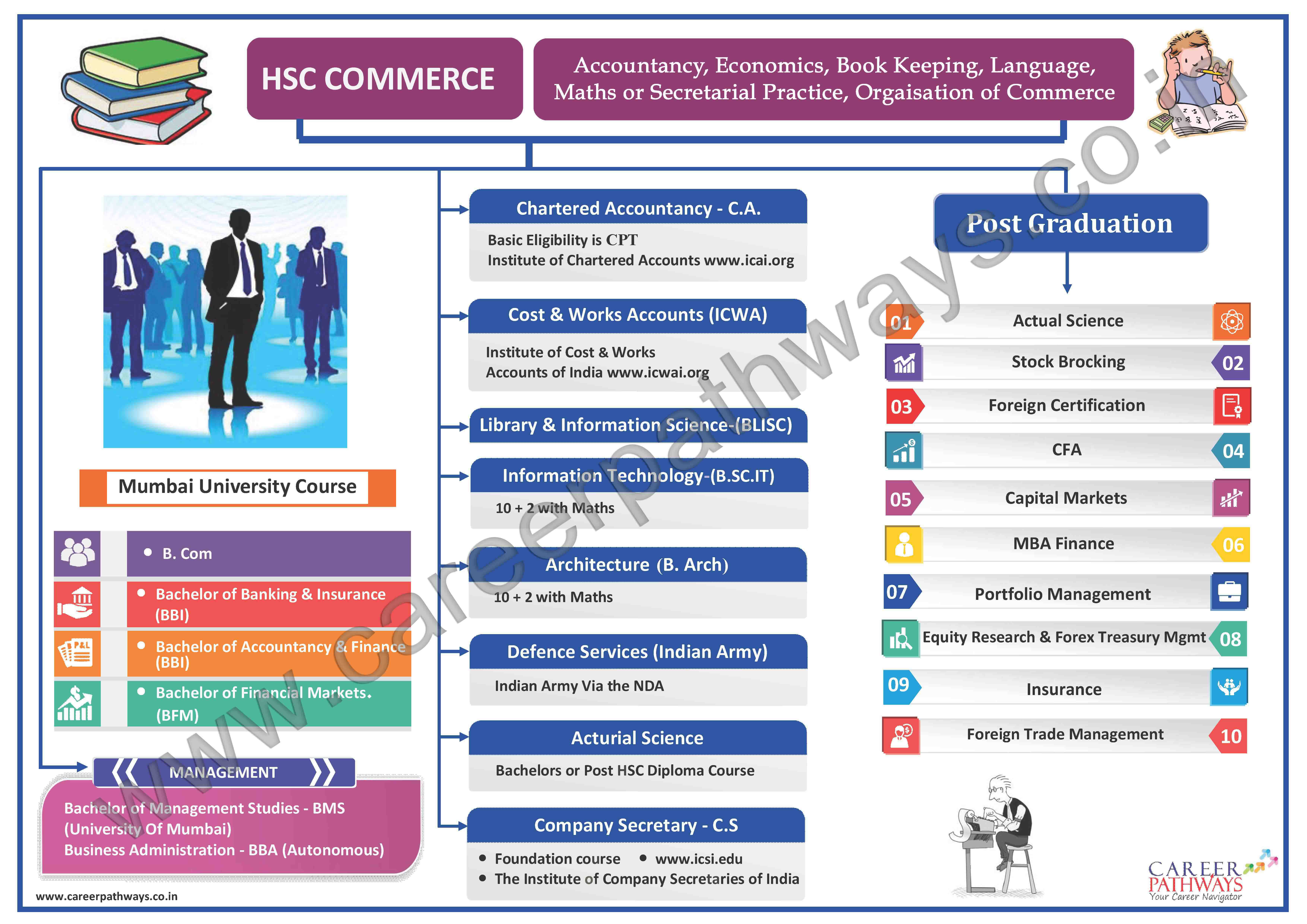

Career in Commerce

- Home

- /

- Articles

Company Secretary:

Company Secretary acts as an interface between the company and its Board of Directors, shareholders, government and regulatory authorities to ensure that

Board procedures are both followed and regularly reviewed. For more information contact: Institute of Company Secretaries Of India. 13, Jolly Maker Chambers

No. 2. Nariman point, Mumbai-400021. www.icsi.edu

Cost and Work Accountancy:

Cost and Management Accountants facilitate strategic management decision in respect of economic activities of an organization by their sheer expertise. For more

information contact: The Institute Of Cost & Works Accountants Of India. Rohit Chambers, Janmabhoomi Marg, Mumbai - 400 001. www. icwai.com

Chartered Public Accountant:

To work as an accountant or internal auditor in the US one needs professional recognition through certification or licensure. CPA is one such requirement. To

become a CPA one needs to complete a programme of study in accounting at a college or university. American Institute of Certified Public Accountant, New York

AICPA recommends 150 semester hours of college study, which in the Indian context would be B.Com., or higher, CA, CWA, CA, MBA equivalent; pass the uniform

CPA examination developed by AICPA and possess a certain amount of professional work experience in public accounting. For more information one could contact

the institute at the following address: National Institute Of Certified Public Accountants. ICFAI, 816, Dalamal Towers, Nariman Point. ?: 2040888/2823173.

CISA (Certified Information Systems Auditor):

The roles of Information Stems Auditor and Information Security Auditor are becoming very significant. So CISA certification definitely opens up doors to many

opportunities. A Certified Information Systems Auditor or CISA is an independent expert who is qualified to perform information systems audit. This has uplifted

the status of the CISA designation, which is often a mandatory qualification for an information systems auditor. The CISA exam is offered annually during the

months of June and December. For more information one could log on to www.isaca.org

Chartered Financial Analyst (CFA):

Chartered Financial Analyst (CFA) primarily focuses on the financial analysis. The programme imparts training in the fields of corporate finance, investment

management and financial services. The CFA programme is better suited for executives who want to enhance their skills in the field of finance. The CFA programme

is conducted by Institute of Chartered Financial Analysts of India (ICFAI). The course targets two broad groups, namely Executives and Graduates. Candidates

seeking admission to the CFA programme have to appear for an admission test. The test is based on verbal and quantitative reasoning which seeks to test the

aptitude of the candidates for professional studies in Financial Analysis. The course is divided into 4 modules namely Foundation, Preliminary, Inter and Final.

Graduates and students in the final year of their Bachelor's degree in any discipline are eligible for admission to the programme.

Insurance and Risk Management:

Insurance management caters to the needs of those already employed in the insurance sector and those seeking employment in the sector. The objective of the

course is to impart the latest knowledge, practical experience, and build attitudes and competencies,which will be valuable for an insurance professional in today's

competitive and challenging environment. Students could pursue this field as a part time or a full time course after graduation.

Institutes:

Narsee Monjee Inst. Of Management Studies, Mumbai.

KC College Of Management Studies, Mumbai.

Tax Management:

Tax managers legally ensure minimum incidence of tax. Their nature of job includes coping up with taxation laws and policies on national as well as international

scale depending on the kind of company they work for. Tax management relates not only to direct taxes e.g. income tax but to indirect taxes like sales tax, excise

tax, agricultural income tax etc. Students could pursue this field as a part time or a full time course after graduation.

Institutes:

Bombay Institute of Commerce, Mumbai.

Welingkar Institute of Management, Mumbai.

Financial Management:

The management of the finances of a business/organization in order to achieve financial objectives is the basic objective of financial management. The nature of

work involves creating wealth for the business, generating cash and providing an adequate return on investment, bearing in mind the risks that the business is

taking and the resources invested. Financial Planning is one of the key elements of financial management.The Chartered Financial Planner (CFP) course is presently

offered in India by two authorised education providers of the Association of Financial Planners (AFP) in technical collaboration with the Financial Planning

Association of Australia Ltd. (FPA). The 2-year distance-learning programme covers topics such as insurance planning and risk management, retirement planning,

tax and estate planning, employee benefits, wealth creation, budgeting, cash flow management, debt management and financial plan construction. Alternatively, an

MBA/CFA/CA/Insurance specialisation - singly or in combination, would also give you a broad understanding of the various investment instruments and options,

and their implications.

Portfolio Management:

Portfolio managers evaluate performance of debt portfolios periodically to identify faults in performance of investments. The Portfolio Management Services (PMS)

help investors make an intelligent and informed choice. Portfolio Management includes effective investment planning after paying due consideration to fiscal and

monetary policies of the government and industrial & economic environment. It also includes constant review of investments. The career of Portfolio Management

can be taken-up by accounting professionals like chartered accountants, certified financial analysts, cost and work accountants, company secretary and a person

who has done MBA in finance. A Certified International Investment Analyst (CIIA) programme is offered in India by ICFAI University through its affiliate Council for

Portfolio Management and Research.

Institutes:

ICFAI University , India.

Investment Management:

Investment Management is a specialized branch of management wherein various assets, securities, funds, stocks, real estate are managed to deliver what the

investors need. The investment manager, who is specialized in a particular field, typically represents investors and offer their services for wealth management or

portfolio management. The curriculum includes asset selection, plan implementation, financial analysis, stock management, monitoring of current investment and

other elements. Investment management courses define various investment styles, long-term returns, etc.

Institutes:

The Narsee Monjee Institute of Management Studies, Mumbai.

ICFAI University.

Export-import Management:

The course aims at providing a comprehensive coverage including all important subject areas & disciplines relevant to international marketing operations. The

course covers International Marketing, International Business Environment, International Marketing Research, Financial Management of Export Enterprises,

Managerial Economics, International Procedures & Documentations and so forth.

Institutes:

K. C. CMS Business School.

Welingkar Institute of Management Studies.

Family Business Management:

Family Business Management addresses those intending to manage family businesses. The stream focuses on the issues problems and unique concerns of family

businesses. The students learn to manage the dynamics of family businesses and are guided to develop strategies for long term expansion and diversification of

their family firms.

Institutes:

Narsee Monjee Institute of Management Studies.

SP Jain Institute of Management.

Capital Markets:

As the condition of capital markets are constantly improving, it has started drawing attention of lot more people than before. On the career related aspects,

professionals have opportunities to choose from for a wide range of jobs available in a number of organisations in this sector and one can expect to have good

times ahead of him. The most common areas of work in the capital markets include stock broking, Investment analysis and equity analysis.

Institutes:

Mumbai Education Trust, Mumbai.

Welingkar Institute of Management, Mumbai.

Institute of Financial and Investment Planning, Mumbai.

BLB Institute of Financial Markets Ltd., Mumbai.

The Bombay Stock Exchange Trading Institute.

Actuarial Science:

Actuarial Science is a field that applies mathematical and statistical techniques to finance and insurance. It is primarily concerned with risk assessment. Essentially,

this involves calculation of insurance risks, policy premiums and so forth. An actuary is thus involved in the designing of insurance and premium plans,

deciding premium rates, minimising loss and maximising gains for his company.

Institutes:

Actuarial Society of India

Narsee Monjee Institute of Management Studies

ICFAI Business School

S.N.D.T. Women's University

Management:

Management entails in-depth study of various business functions and processes; marketing, finance, computers, human resources, production and so forth; the

study of which would eventually help the individual to accomplish organizational goals. Managers are the people who through their planning, organizing, directing

and controlling skills achieve the desired goals. Traditionally, management offers three major specializations: finance, marketing, and human resource. Many other

specializations are today also available, such as information technology, rural management, entrepreneurial management, import export management, IT,

personnel, telecom, and so forth.

Institutes:

Jamnalal Bajaj Institute of Management.

S.P. Jain Institute of Management.

Indian Institutes of Management (IIM's)

Welingkar Institute of Management.

Banking:

Banking has emerged as one of the most challenging sectors in the country. Openings are available at various levels, from the clerical positions to the probationary

officers (PO) positions. Recruitment for the public sector banks is done through the Banking Service Recruitment Boards (BSRBs).

Institutes:

National Institute of Bank Management, Pune.

Narsee Monjee Institute of Management Studies, Mumbai.

Indian Institute of Bankers, Mumbai.

Indian Institute of Banking and Finance,Mumbai.

Other Options:

Other than the regular B.Com degree, the University of Mumbai now offers three specialisations for commerce students: the Bachelor of Banking and Insurance

(BBI), the Bachelor in Accounts and Finance (BAF) and the Bachelors in Financial Markets (BFM).

Bachelor of Banking and Insurance (BBI):

The Bachelor of Banking and Insurance is a three year course that provides students with basic understanding about the banking and insurance sector while aiming

to familiarise students with the operational environment in this field. The course focuses on financial management, law, management, accounting, international

banking, security analysis, insurance, economics, accounting, international banking, corporate law, central banking, universal banking.

Bachelor of Accounts and Finance (BAF):

The Bachelor of Accounts and Finance focuses on detailed study of Accounts and Management of Finance. This three year course entails the study of core finance

subjects like financial accounting, economics, auditing, financial management, business law, taxation , vat, sales tax, forex, capital markets. Future prospects in this

field include pursuing Chartered Accountancy, Actuarial Sciences, Financial Analysis or even MBA.

Bachelors of Financial Markets (BFM):

The Bachelors of Financial Markets, a three year degree coursefocusing on the study of capital markets. This field of study incorporates topics like corporate finance,

capital markets, debt, equity commodities, securities, global capital markets, mutual fund management and so forth. Graduates in this field can further plan to apply

to banks for jobs and even pursue management studies or insurance certifications.